CARES Act 2.0: 2026 Unemployment Benefits Changes & Solutions

The CARES Act 2.0 is set to redefine unemployment benefits in the United States by 2026, introducing critical structural modifications to support and stabilize the workforce through evolving economic landscapes.

As the United States economy continues to evolve, so too does its safety net for workers. The upcoming changes under The CARES Act 2.0: What 2026 Changes Mean for Unemployment Benefits in the United States (PRACTICAL SOLUTIONS) are generating significant discussion among policymakers, economists, and, most importantly, American workers. Understanding these adjustments is crucial for navigating potential periods of joblessness and ensuring financial stability. This article will break down the anticipated reforms, offering practical insights and solutions for a more resilient future.

Understanding the Evolution of Unemployment Benefits

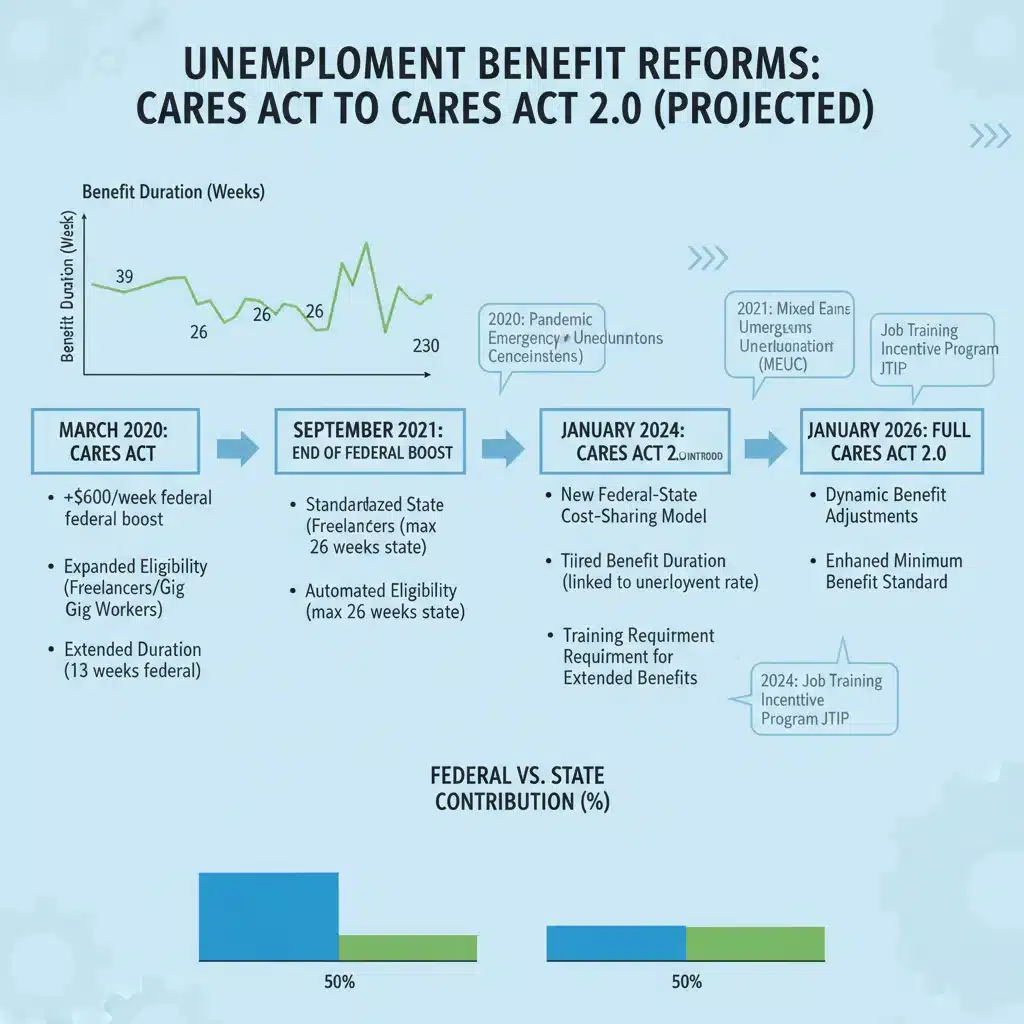

Unemployment benefits have long served as a critical lifeline for millions of Americans during economic downturns and personal job loss. The original CARES Act, enacted in response to the COVID-19 pandemic, dramatically expanded these benefits, providing unprecedented federal support. Now, as the nation looks towards 2026, a new iteration, often referred to as CARES Act 2.0, is expected to introduce more permanent, structural changes to the system.

This evolution isn’t merely a continuation of previous policies; it represents a strategic recalibration designed to address lessons learned from past crises while preparing for future economic uncertainties. The goal is to create a more responsive, equitable, and sustainable unemployment insurance (UI) system. These adjustments will likely impact how benefits are funded, who qualifies, and for how long support can be received, fundamentally altering the landscape of worker assistance.

Historical Context and Lessons Learned

The original CARES Act highlighted both the strengths and weaknesses of the existing UI framework. While it provided immediate relief, it also exposed administrative bottlenecks and questions about the optimal balance between federal and state responsibilities. Policymakers are now leveraging this experience to refine the system.

- Pandemic Unemployment Assistance (PUA): Extended eligibility to self-employed and gig workers, revealing a need for broader coverage.

- Federal Pandemic Unemployment Compensation (FPUC): Provided an extra weekly sum, demonstrating the impact of enhanced benefits on economic stability.

- State Administrative Challenges: Overwhelmed state UI agencies underscored the need for modernized technology and streamlined processes.

The lessons from these experiences are directly informing the proposed changes under CARES Act 2.0, aiming for a system that is both robust in times of crisis and efficient in its day-to-day operations. This forward-looking approach seeks to mitigate future economic shocks more effectively.

In essence, the evolution of unemployment benefits from the original CARES Act to the anticipated CARES Act 2.0 reflects a national commitment to refining economic safety nets. These upcoming changes are not just about numbers; they are about fostering greater economic security and adaptability for the American workforce in the face of an ever-changing global economy.

Key Structural Changes Expected in 2026

The anticipated CARES Act 2.0 is expected to bring significant structural changes to the unemployment benefits system in the United States by 2026. These reforms aim to create a more resilient and adaptable framework, moving beyond the temporary measures of the initial CARES Act. Understanding these foundational shifts is crucial for anyone who might rely on or administer these benefits in the coming years.

One primary area of focus is the federal-state partnership in funding and administering UI programs. Historically, states have managed their own UI systems with some federal oversight and occasional supplemental funding during recessions. CARES Act 2.0 is likely to codify a more permanent federal role, potentially establishing clearer guidelines for benefit duration and eligibility across states, reducing disparities that became evident during the pandemic.

Federal Funding and State Modernization

The proposed legislation is expected to include provisions for enhanced federal funding for state UI administration, contingent on modernization efforts. This could mean significant investments in outdated IT systems, which proved to be a major bottleneck during the COVID-19 unemployment surge. The goal is to process claims more efficiently and accurately, reducing delays for claimants.

- Mandatory Technology Upgrades: States may be required to adopt modern, interoperable systems to streamline applications and payments.

- Increased Federal Reimbursement: Higher federal contributions to state administrative costs could incentivize compliance and improvement.

- Data Sharing Standards: New mandates for data sharing between states and federal agencies to improve fraud detection and program oversight.

These changes are designed to address the systemic issues that plagued the UI system, ensuring that it can handle future surges in claims without collapsing under the pressure. The emphasis is on creating a robust digital infrastructure that benefits both claimants and administrators.

Another significant structural change could involve triggers for extended benefits. Rather than requiring congressional action for each economic downturn, CARES Act 2.0 might implement automatic triggers based on economic indicators, such as a sustained rise in the national unemployment rate. This would allow for a more immediate and automatic response to economic crises, providing quicker relief to affected workers. These structural adjustments are poised to redefine the operational backbone of the American unemployment benefits system, making it more robust and responsive to future challenges.

Expanded Eligibility and Benefit Duration Adjustments

The scope of who qualifies for unemployment benefits and for how long they can receive them is a cornerstone of the anticipated CARES Act 2.0 changes for 2026. The pandemic highlighted significant gaps in the traditional unemployment insurance system, particularly concerning non-traditional workers. The new legislation aims to address these disparities, broadening the safety net for a more diverse workforce.

A key focus is expected to be on codifying protections for gig workers, independent contractors, and self-employed individuals who were previously excluded from standard UI programs. The Pandemic Unemployment Assistance (PUA) program under the original CARES Act provided temporary relief to these groups, demonstrating the vital need for their inclusion. CARES Act 2.0 is likely to establish permanent mechanisms for these workers to access unemployment support, recognizing the changing nature of employment.

Redefining ‘Worker’ in the Modern Economy

The definition of an eligible worker for unemployment benefits is undergoing a significant re-evaluation. With the rise of the gig economy and flexible work arrangements, the traditional employer-employee model no longer encompasses a large segment of the labor force. CARES Act 2.0 is expected to reflect this reality, ensuring that more Americans have access to support when they lose work.

- Inclusion of Gig Workers: Permanent provisions for independent contractors and freelancers to claim benefits, potentially with tailored eligibility criteria.

- Broader Income Definitions: Consideration of various income streams beyond traditional wages for benefit calculation.

- Flexible Work History Requirements: Adjusted requirements to accommodate intermittent or project-based work, rather than solely continuous employment.

These changes aim to create a more inclusive system that mirrors the complexities of the 21st-century labor market. By redefining who qualifies, the CARES Act 2.0 seeks to strengthen economic security for a wider array of workers.

Beyond eligibility, adjustments to benefit duration are also on the table. While traditional state UI typically offers 26 weeks of benefits, the original CARES Act extended this significantly. CARES Act 2.0 might introduce a more flexible duration model, potentially tying extensions to local or national economic conditions rather than fixed periods. This adaptive approach would ensure that benefits last longer during severe economic downturns, providing sustained support when job opportunities are scarce, while reverting to standard durations during periods of economic stability. These expanded eligibility and duration adjustments aim to build a more responsive and comprehensive unemployment safety net.

Impact on State UI Agencies and Administrative Capacity

The impending changes under CARES Act 2.0 will undoubtedly place significant demands on state unemployment insurance (UI) agencies, fundamentally altering their operational landscape. These agencies, which bore the brunt of the administrative challenges during the initial pandemic response, are now facing a mandate for modernization and increased capacity. The reforms are not just about policy; they are about the practical execution of a more robust system.

Many state UI systems operate on decades-old technology, leading to processing delays, fraud vulnerabilities, and a frustrating experience for claimants. CARES Act 2.0 is expected to provide incentives and, potentially, requirements for states to upgrade their technological infrastructure. This includes moving towards cloud-based systems, enhancing cybersecurity, and implementing user-friendly online portals for claims and inquiries.

Challenges and Opportunities for Modernization

While the push for modernization is critical, it presents both significant challenges and opportunities for state agencies. The initial investment in new systems can be substantial, and the transition requires careful planning and execution to avoid service disruptions. However, successful modernization promises long-term benefits in efficiency and claimant satisfaction.

- Funding for IT Infrastructure: Federal grants or matching funds specifically earmarked for UI system upgrades.

- Staff Training and Development: Programs to equip state employees with the skills needed to manage new technologies and complex benefit structures.

- Interoperability Standards: Development of common data standards to facilitate seamless information exchange between states and federal agencies.

These initiatives are designed to transform state UI agencies from reactive processing centers into proactive service providers, capable of handling fluctuating claim volumes with greater ease. The goal is to prevent the administrative backlogs and payment delays that characterized previous crises.

Furthermore, CARES Act 2.0 may introduce new reporting requirements and performance metrics for states. This could include mandates for faster claim processing times, lower error rates, and improved customer service. Meeting these new standards will necessitate not only technological upgrades but also a re-evaluation of staffing levels and operational workflows within state agencies. The federal government’s increased involvement will likely come with greater oversight, ensuring that states are adequately prepared to implement the expanded provisions. Ultimately, the success of CARES Act 2.0 hinges on the ability of state UI agencies to adapt and evolve their administrative capacities effectively.

Practical Solutions for Workers and Businesses

Navigating the evolving landscape of unemployment benefits under CARES Act 2.0 requires proactive engagement from both workers and businesses. Understanding the practical implications of the 2026 changes can help individuals secure their financial future and enable businesses to better manage their workforce and contributions. This section outlines actionable strategies to adapt to the new framework.

For workers, the primary solution lies in staying informed and preparing for potential shifts in eligibility and benefit structure. This means regularly checking official government resources for updates on CARES Act 2.0 implementation and understanding how the new rules might apply to their specific employment situation, especially for those in the gig economy or with non-traditional work histories. Proactive planning is key to maximizing available benefits.

Strategies for Workers

Workers should take several steps to ensure they are prepared for the 2026 changes. This extends beyond merely knowing the rules to actively managing personal finances and career development.

- Document Work History Thoroughly: Maintain detailed records of all employment, including freelance gigs and contract work, as new eligibility criteria might rely on comprehensive documentation.

- Build an Emergency Fund: While benefits provide a safety net, an emergency fund offers additional security during periods of unemployment, especially as benefit durations may vary.

- Invest in Skills Development: Continuously update skills to remain competitive in the job market, reducing the likelihood of prolonged unemployment.

These strategies empower workers to be resilient, reducing reliance solely on unemployment benefits and fostering greater financial independence. Understanding the new system allows for a more informed approach to career and financial planning.

Businesses, on the other hand, face the need to understand potential changes in their UI tax obligations and workforce management strategies. CARES Act 2.0 might introduce new federal parameters for state UI trust funds, which could impact employer tax rates. Businesses should also review their hiring practices and employee classifications to ensure compliance with expanded definitions of eligible workers. This includes re-evaluating how they engage with independent contractors and gig workers to align with potential new benefit structures.

Adjustments for Businesses

Businesses must also adapt to the new regulatory environment, focusing on compliance and strategic planning.

- Review UI Tax Implications: Consult with financial advisors to understand potential changes in state and federal UI tax contributions.

- Audit Worker Classification: Ensure that all workers, particularly independent contractors, are correctly classified according to evolving federal and state guidelines to avoid penalties and ensure benefit access.

- Modernize HR Systems: Invest in HR and payroll systems that can efficiently track diverse work arrangements and comply with new reporting requirements.

By taking these proactive steps, businesses can mitigate risks, maintain compliance, and contribute to a more stable employment ecosystem. The practical solutions under CARES Act 2.0 emphasize preparedness and adaptability for all stakeholders.

Economic Implications and Future Outlook

The economic implications of CARES Act 2.0 and its 2026 changes to unemployment benefits are far-reaching, touching upon national economic stability, consumer spending, and labor market dynamics. These reforms are not merely administrative adjustments; they represent a strategic federal intervention designed to cushion future economic shocks and foster a more resilient economy. Understanding these broader impacts is crucial for policymakers, businesses, and individuals alike.

One direct economic implication is the potential for enhanced counter-cyclical stabilization. By making unemployment benefits more responsive to economic downturns, CARES Act 2.0 aims to automatically inject funds into the economy during recessions, supporting consumer demand and preventing deeper economic contractions. This built-in stabilizer could reduce the need for ad-hoc legislative interventions during future crises, providing greater predictability.

Impact on Labor Market and Wages

The changes in eligibility and duration could also influence labor market dynamics. Expanded coverage for gig workers and independent contractors might reduce precarity in these sectors, potentially leading to more stable consumption patterns. However, there are also considerations regarding the potential impact on wage growth and labor supply.

- Reduced Labor Market Friction: More robust benefits could allow workers more time to find suitable employment, rather than taking the first available job.

- Potential for Wage Pressure: Enhanced benefits might empower workers to demand higher wages, influencing overall compensation trends.

- Encouragement of Entrepreneurship: A stronger safety net could incentivize more individuals to pursue self-employment or gig work, knowing they have some protection.

These labor market effects are complex and will require careful monitoring as CARES Act 2.0 takes full effect. The balance between providing adequate support and incentivizing work remains a critical policy consideration.

From a fiscal perspective, the increased federal role in funding and administration implies a potentially larger federal budget commitment to unemployment insurance. While this aims to strengthen the system, it also raises questions about long-term fiscal sustainability and the division of financial responsibility between federal and state governments. The future outlook suggests a UI system that is more integrated, more technologically advanced, and more responsive to a wider range of economic conditions and worker types. The success of these reforms will be measured not only by their ability to provide immediate relief but also by their contribution to long-term economic stability and equitable growth across the United States.

Preparing for the Future: Long-Term Strategies

As the United States approaches 2026 and the implementation of CARES Act 2.0, preparing for the future of unemployment benefits requires a forward-thinking approach from all stakeholders. This involves not just understanding the immediate changes but also developing long-term strategies that foster economic resilience, adaptability, and continuous improvement within the unemployment insurance system. The goal is to build a system that is robust enough to withstand future economic uncertainties and equitable enough to serve all workers effectively.

For individuals, a key long-term strategy involves cultivating financial literacy and personal savings habits. While unemployment benefits provide a crucial safety net, they are rarely a substitute for a comprehensive financial plan. Workers should focus on creating diversified income streams, investing in portable skills, and building emergency savings that can cover several months of living expenses. This proactive financial management reduces dependence on external support and enhances personal economic security.

Policy Recommendations and Continuous Improvement

Policymakers, meanwhile, must commit to continuous evaluation and improvement of the UI system. CARES Act 2.0 is a significant step, but the economic landscape is dynamic, requiring ongoing adjustments. This includes regular reviews of benefit adequacy, duration, and eligibility criteria to ensure they remain relevant to the modern workforce and economy.

- Data-Driven Policy Adjustments: Utilize real-time economic data to inform decisions on benefit levels and triggers for extensions.

- Cross-Agency Collaboration: Foster stronger partnerships between UI agencies, workforce development programs, and educational institutions to facilitate reemployment.

- Fraud Prevention and Security: Continuously invest in advanced technologies and protocols to protect the integrity of the UI system against fraud and cyber threats.

These recommendations emphasize an adaptive and evidence-based approach to policy-making, ensuring that the UI system remains effective and trustworthy. The focus should be on creating a feedback loop where policy outcomes inform future legislative adjustments.

For businesses, long-term strategies include investing in workforce development and employee retention programs. By offering continuous training, upskilling opportunities, and competitive compensation, companies can reduce employee turnover and enhance their workers’ long-term employability. Furthermore, businesses should advocate for stable and predictable UI tax structures, contributing to the health of state UI trust funds. This collaborative approach between businesses, workers, and government is essential for building a sustainable and equitable unemployment benefits system that truly serves the needs of the American people in the years to come. The long-term success of CARES Act 2.0 hinges on this collective commitment to adaptation and improvement.

| Key Point | Brief Description |

|---|---|

| Federal-State Partnership | CARES Act 2.0 aims for a more permanent federal role in UI funding and administration, reducing state disparities. |

| Expanded Eligibility | Permanent inclusion of gig workers, independent contractors, and self-employed in UI benefits. |

| State UI Modernization | Mandates and funding for states to upgrade outdated IT systems and streamline claims processing. |

| Adaptive Benefit Duration | Flexible benefit duration potentially tied to economic indicators for more responsive support. |

Frequently Asked Questions About CARES Act 2.0 and Unemployment

The primary goal of CARES Act 2.0 is to establish a more permanent, resilient, and equitable unemployment insurance system. It aims to address lessons from the pandemic, modernize state UI agencies, and broaden eligibility to include a wider range of workers, like those in the gig economy, ensuring better preparation for future economic challenges.

CARES Act 2.0 is expected to permanently extend unemployment benefits to gig workers and independent contractors. This marks a significant shift from traditional UI, recognizing the evolving nature of work. Specific eligibility criteria and benefit calculation methods for these non-traditional workers will be a key component of the new legislation.

State UI agencies are anticipated to undergo significant modernization, driven by federal incentives and mandates under CARES Act 2.0. This includes upgrading outdated IT systems, enhancing cybersecurity, and streamlining claim processing. The goal is to improve efficiency, reduce delays, and increase the administrative capacity to handle high volumes of claims more effectively.

Yes, CARES Act 2.0 may introduce a more flexible and adaptive model for benefit duration. Instead of fixed periods, extensions could be tied to specific economic indicators at national or local levels. This aims to ensure that benefits last longer during severe economic downturns, providing sustained support when job opportunities are scarce.

Individuals should stay informed about the specific changes by checking official government sources. Practical steps include meticulously documenting work history, especially for non-traditional employment, building an emergency savings fund, and continuously investing in skills development to enhance long-term employability and financial resilience.

Conclusion

The anticipated CARES Act 2.0 changes for 2026 represent a pivotal moment for unemployment benefits in the United States. These reforms are designed to create a more robust, equitable, and responsive system, learning from past challenges and adapting to the evolving nature of work. By expanding eligibility, modernizing state agencies, and recalibrating benefit structures, the legislation aims to provide a stronger safety net for all American workers. Both individuals and businesses must proactively engage with these changes, understanding their implications and implementing practical solutions to ensure economic stability and resilience in the years ahead. The future of unemployment benefits hinges on a collaborative commitment to adaptation and continuous improvement.